ACA Howe Newsletter - January 2017

Welcome to the New Year edition of the ACA Howe International UK newsletter. We hope that you enjoyed the festive period and wish you all the best for 2017!

In 2016, our geologists, mining engineers and metallurgists worked on a variety of projects, which included technical reporting, resource estimation, project appraisal, 3D modelling and database management for projects in Africa, Europe and South America.

A rebound in many metals prices and improved investor sentiment in 2016 has given cause for optimism going into 2017 and we look forward to the months ahead.

Industry News

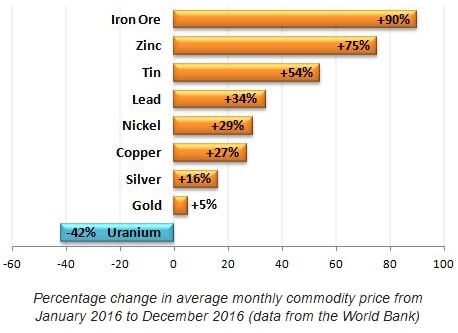

As indicated in our April 2016 newsletter, we saw signs of life emerging in the mining industry in early 2016 as many metals prices climbed well above their 2015 lows. Although the Brexit vote and the US election caused some global economic uncertainty, overall the rise in commodity prices continued. This comes as a welcome change after recent years of decreasing commodity prices and low levels of investment in the industry.

The biggest gains were seen in iron ore, zinc and tin, while copper made a late surge to finish 27% up on the average price in January 2016. Copper is now widely predicted to be a strong performer in 2017. The uranium price, however, continued its slide, falling 42% from its average price in January.

Cutbacks in both capacity and expenditure by miners have played a part in the increased prices, while a focus on improving productivity and the introduction of new technology has provided confidence that the industry can move forward in a positive manner.

In addition, during 2015 there was speculation that the Chinese economy would suffer a hard landing. This has been avoided to date and investment in infrastructure has lead to increased demand for commodities.

Further to this, Donald Trump's election as president of the United States has lead to speculation of increased demand for commodities due to his proposal for $1 trillion of additional investment in infrastructure over a 10 year period. It should be noted that it is yet to be confirmed that this level of investment will, in fact, be introduced and what the effect on commodity prices would be.

Comments from some analysts, such as Andy Cole of Metal Bulletin Research, provide further confidence that the industry is on the up:

“Investors are coming back to commodities, recognising that after 5 years in a bear market, the asset class found a floor in 2016 and has begun its next cyclical upswing”.

The turnaround is still in its infancy and there will be ups and downs, but it is expected that the upward trend will continue and we hope that some of the projects that have been on hold in recent years will restart in 2017.

Client News

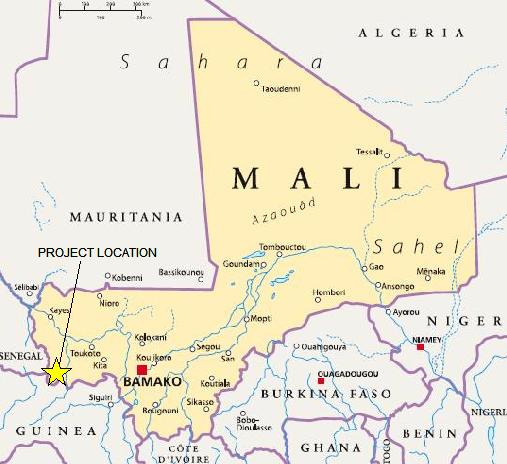

We would like to take this opportunity to congratulate our client, Merrex Gold, on their recent definitive agreement to sell all shares in the company to IAMGOLD Corporation (subject to approvals).

We would like to take this opportunity to congratulate our client, Merrex Gold, on their recent definitive agreement to sell all shares in the company to IAMGOLD Corporation (subject to approvals).

Merrex Gold and IAMGOLD Corporation have worked on the Siribaya Project in Mali under a 50-50% joint-venture agreement since the end of 2011. The project includes a NI 43-101 indicated resource estimate of 4 million tonnes grading 2.34 g/t Au and inferred resource of 4.3 million tonnes grading 2.17 g/t Au.

The discovery of the Diakha deposit, reported in February 2016, added indicated resources of 2.1 million tonnes averaging 1.9 g/t Au and inferred resources of 19.8 million tonnes averaging 1.71 g/t Au.

ACA Howe UK’s first involvement in the project was the completion of a NI 43-101 compliant technical report and resource estimate for the Siribaya Gold Project in 2009. This was followed by a mineral resource estimate update in 2010 and reports on the exploration potential of the Merrex Gold portfolio in 2011. More recently, ACA Howe advised Merrex Gold on the resource potential of the Diakha Project.

© 2017 A.C.A. Howe International Limited